PRELIMINARY COPY – SUBJECT TO COMPLETION – DATED AUGUST 11, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE

Securities Exchange Act of 1934

(Amendment No. )AMENDMENT NO. 1)

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

☒ | | | Preliminary Proxy Statement |

☐ | | | Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

☐ | | | Definitive Proxy Statement |

☐ | | | Definitive Additional Materials |

☐ | | | Soliciting Material under §240.14a-12 |

Freshpet, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ | | | No fee required. | |||

☐ | | | Fee paid previously with preliminary materials. | |||

☐ | | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules | |||

TO OUR FELLOW STOCKHOLDERS

Thank you for your support of Freshpet, Inc. On behalf of the entire Board of Directors of Freshpet (the “Board”), we invite you to attend Freshpet’s 2022 Annual Meeting2023 annual meeting of Stockholdersstockholders (including any adjournments, postponements or continuations thereof, the “Annual Meeting”) scheduled to be held on October 3, 2022[•], 2023 at 8:00 a.m., Central Time. Our 2022[•] a./p.m. Eastern Time in a virtual meeting format, via a live webcast. The Annual Meeting will once again be conducted in-person at our newest Freshpet Kitchen located at 4800 Sterilite Drive, Ennis, TX 75119, as well as virtually via webcast at www.virtualshareholdermeeting.com/FRPT2022. Each holderin a virtual format, which will provide stockholders the opportunity to participate irrespective of location. Stockholders of record as of the close of business on August 9, 202218, 2023 may vote their shares either in-person or electronically at the annual meeting,Annual Meeting, as further described in the accompanying Notice of Annual Meeting of Stockholders and Proxy Statement.proxy statement detailing the business to be conducted at the Annual Meeting (the “Proxy Statement”).

In 2023, Freshpet made significant progress executing its operational improvement plan to drive margin expansion, initiated in August 2022. Guided by the strategy set by Freshpet’s management team and world-class Board, we are steadily advancing the key drivers of cost and margins while delivering strong revenue growth in line with our long-term growth plan. With continued execution, we believe that the growth opportunity for Freshpet is enormous.

We are confident our progress will allow us to deliver continued momentum and future success. We are pleased to offer our stockholders this hybrid meeting format to promote greater stockholder engagement, while providing flexibility to attend in-person or participate virtually. Importantly, our stockholders attending the annual meeting virtually will have the same rights to participatewelcome Walter N. George III into his role as those stockholders attending in-person. Because the health and well-beingindependent Chair of our employees, stockholdersBoard, effective as of July 21, 2023. Walt, formerly Chair of the Nominating, Governance and other meeting participants remainsSustainability Committee of utmost importance, in-person attendancethe Board, has over 30 years of manufacturing and supply chain leadership experience, including senior positions in the pet food industry and significant expertise in scaling multiple high-growth consumer product companies that position him well to lead our Board. We also want to thank former Chair of the Board Charles A. Norris for his many years of dedication to Freshpet and his leadership of the Board since our initial founding. Charlie’s insights have contributed significantly to Freshpet’s revolutionizing of the pet food industry and ongoing evolution, and he has helped put us in a strong position to build momentum and capture many opportunities ahead.

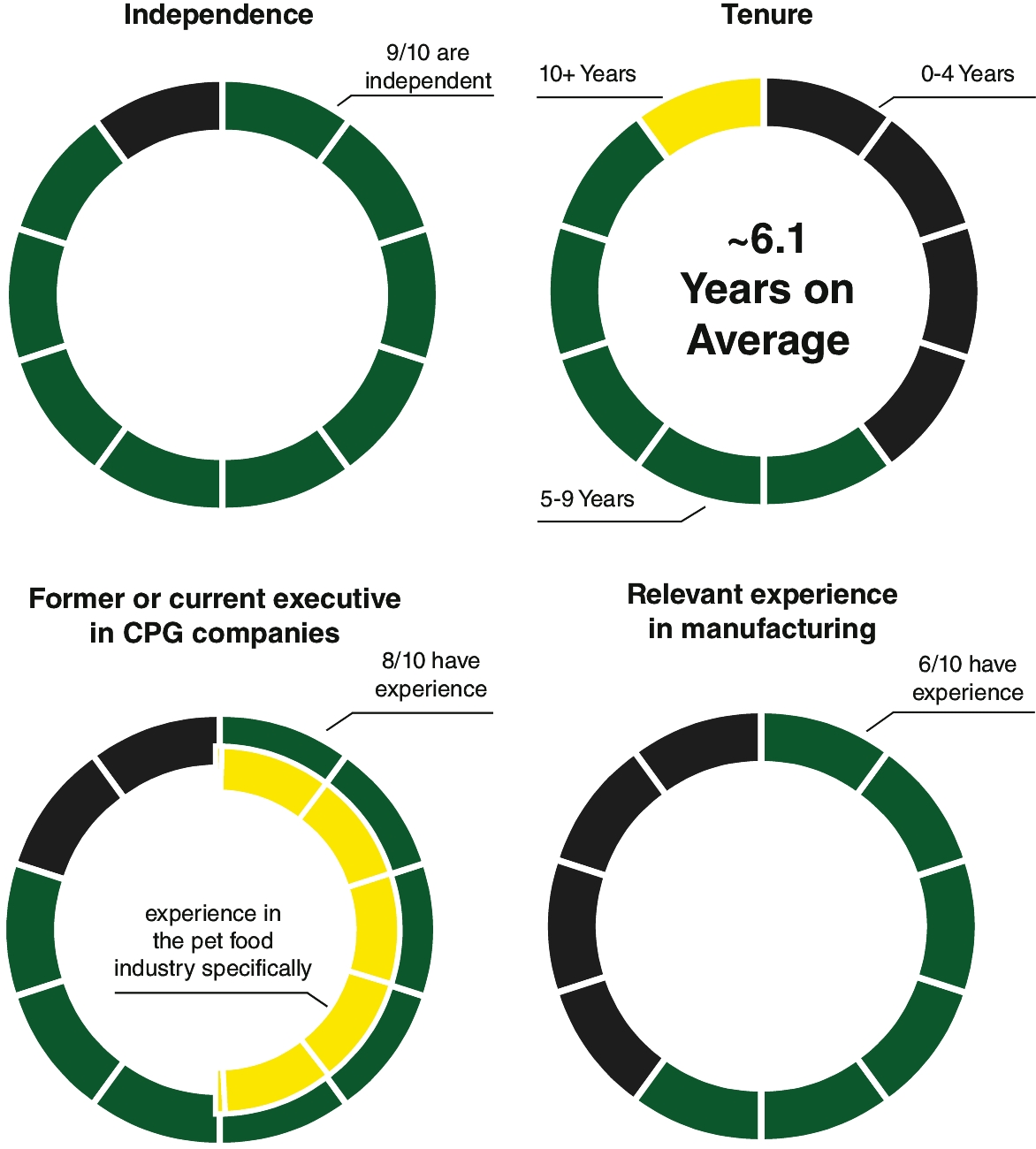

Our Board continues to evolve to ensure it has the right skills and expertise to oversee the continued execution of our strategy and business. Comprised of 9 independent directors and our CEO, our Board has extensive experience in areas critical to growing our business, including retail, supply chain management, consumer packaged goods, technology, marketing and branding, and of course, pet food experience. We are thrilled to have welcomed two new directors to our Board in recent months: David B. Biegger and David J. West. Mr. Biegger joined our Board in May, Mr. West joined in July, and both have been appointed to serve on our Audit Committee. Mr. Biegger is a seasoned supply chain and operations leader with deep domain knowledge and over 40 years of experience in the consumer packaged goods industry. Mr. West is an accomplished pet food and consumer products executive who brings over three decades of experience leading a range of blue-chip consumer companies and well-known brands. We expect Mr. Biegger’s and Mr. West’s guidance and perspectives will require compliance with any then-applicable COVID-19 governmental regulationshelp advance our operational improvement plan to help us deliver margin expansion while we continue to drive top line growth. Our Board also continues to implement our governance transformation plan, as well as our Compensation Committee’s introduction of ESG-related metrics directly into executive compensation, as discussed in greater detail in our Proxy Statement.

Additionally, we recently announced the appointments of Todd Cunfer as Chief Financial Officer and recommendations.

The Board is dedicated to its role as your fiduciary, and our directors’ diverse skills and backgrounds reflect the expertise necessary for effective oversight and guidanceaccompanying Notice of the business. Freshpet is on a mission to change the way people feed their pets forever, and our strategy to lead the transition to fresh and natural food for our pets is aligned with a fundamental shift in how society views both pets and food. The accelerating growth of the Company over the past five years validates that our Feed the Growth strategy is working and has positioned the Company to realize the benefits of its first-mover position in the market’s shift towards higher quality, fresh pet food. As a Board, we have encouraged and guided the management team to continually make the investments necessary to fully realize Freshpet’s long-term potential, including investments in talent, capacity, systems, and advertising. It is our belief that this focus on long-term growth will deliver significant profitability through increased scale and create a sustainable competitive advantage for the Company.

Your vote is creating a solid foundation for the significant growth that lies ahead. We now have the infrastructure, talent, and processes needed to carry Freshpet towards its 2025 goals and beyond.

On behalf of our hourly workforce. As a result, our Compensation Committee has adopted a retention goal as part of our annual bonus calculation for the top executives and set specific metrics for the team to achieve.

support. Thank you for your support and continued interest in Freshpet.being a Freshpet stockholder.

Sincerely,

William B. Cyr

Chief Executive Officer & Executive Director

PRELIMINARY PROXY STATEMENT -COPY – SUBJECT TO COMPLETION – DATED AUGUST 11, 2023

FRESHPET, INC.

to be held on

TO THE STOCKHOLDERS OF FRESHPET, INC.:

The 2022 Annual Meeting2023 annual meeting of Stockholdersstockholders (including any adjournments, postponements or continuations thereof, the “Annual Meeting”) of Freshpet, Inc. (the “Company”) will be held in-personvirtually on [•], October [•], 2023 at the Freshpet Kitchen, 4800 Sterilite Drive, Ennis, TX 75119, and via a live video webcast in a hybrid meeting format. In the continued interest of the health and well-being of our employees, stockholders and other meeting participants, in-person attendance will require compliance with any then-applicable COVID-19 governmental regulations and recommendations.

Time and Date: | | [•], October [•], 2023 at [•] a./p.m Eastern Time | ||||

Place: | | | Via live webcast by visiting [•] | |||

Record Date: | | | The close of business on August 18, 2023 | |||

Items of Business: | | | As described in the | |||

| | 1. | | | Election of four | ||

| 2. | | | Ratification of the appointment of KPMG LLP as |

| 3. | | | Non-binding advisory vote to approve the compensation of the Company’s named executive officers | ||

| | Stockholders will also act on such other matters as may properly come before the Annual Meeting. | |||||

Attendance and Participation at the Annual Meeting: | | | Stockholders as of the Record Date will be able to attend the virtual Annual Meeting by visiting the link above, where you will be able to listen to the meeting live, submit questions, and vote. To participate in the Annual Meeting, you must pre-register at [•] by [•] p.m. Eastern Time on [•], 2023. More information on attending the Annual Meeting can be found in the accompanying Proxy Statement. | |||

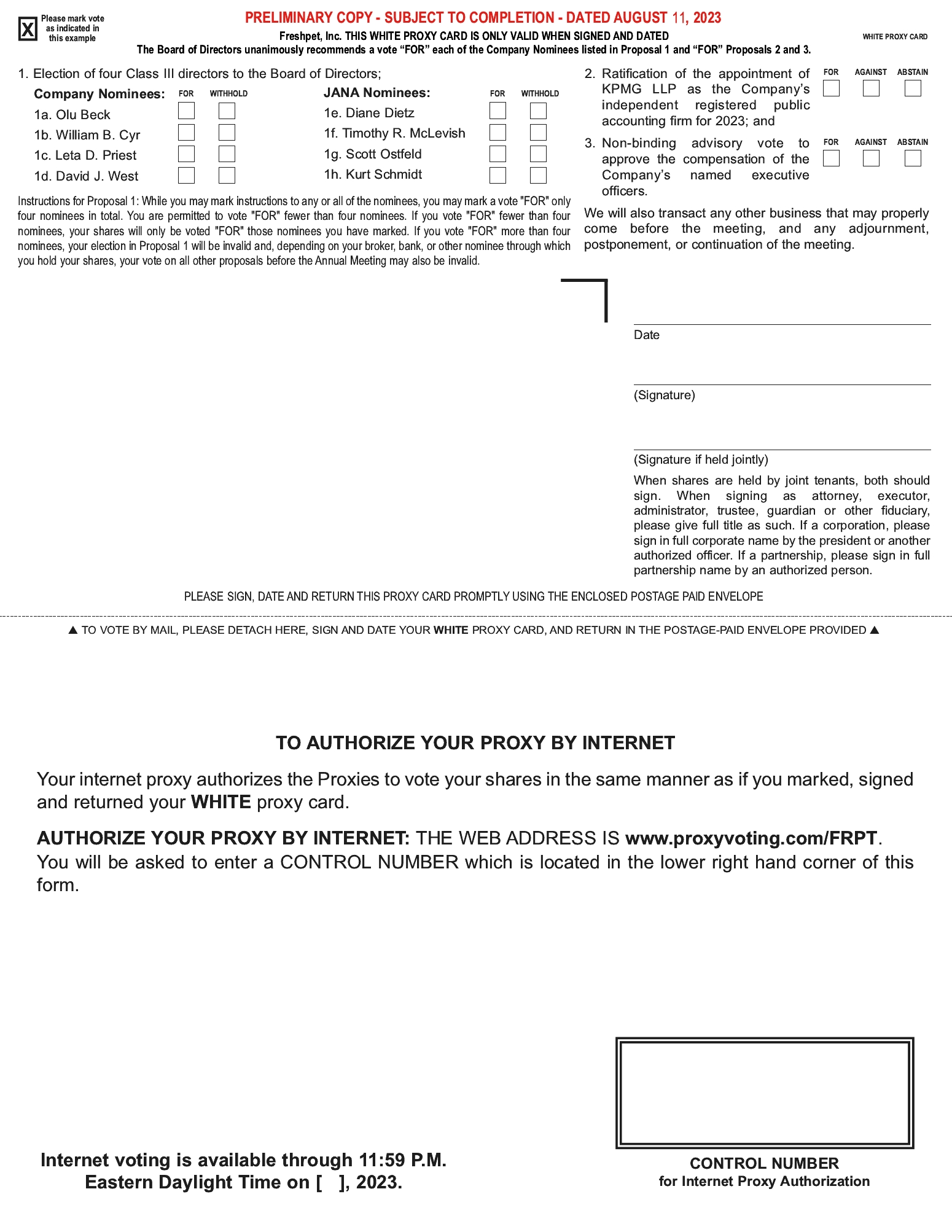

Voting: | | | YOUR VOTE IS VERY IMPORTANT. Whether or not you plan to attend the Annual Meeting, we hope you will vote as soon as possible by following the instructions on the enclosed WHITE proxy card so that your shares are represented and your voice is heard. Returning the proxy does not deprive you of your right to attend the Annual Meeting and to vote your shares at the Annual Meeting. Stockholders of record as of the close of business on the Record Date are entitled to notice of, and to vote at, the Annual Meeting. Such stockholders are urged to submit an enclosed WHITE proxy card, even if their shares were sold after such date. More information on voting your WHITE proxy card and attending the Annual Meeting can be found in the accompanying Proxy Statement and the instructions on the WHITE proxy card. | |||

| | OUR BOARD UNANIMOUSLY RECOMMENDS VOTING “FOR” THE ELECTION OF EACH OF OUR BOARD’S NOMINEES UNDER PROPOSAL 1 AND “FOR” PROPOSALS 2 AND 3 USING THE ENCLOSED WHITE PROXY CARD. | |||||

We urge you to INTERNET: [•] MAIL: complete and |

OUR BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF EACH OF OUR BOARD’S NOMINEES UNDER PROPOSAL 1 AND “FOR” PROPOSALS 2 AND 3 USING THE ENCLOSED WHITE PROXY CARD AND DISREGARD ANY MATERIALS, AND DO NOT SIGN, RETURN OR VOTE ON ANY GREEN PROXY CARD SENT TO YOU BY OR ON BEHALF OF JANA. If you have already completed and signed any green proxy card provided by or on behalf of JANA, you have every legal right to change your vote by completing, signing and dating the enclosed WHITE proxy card and promptly mailing it in the postage pre-paid envelope provided or following the instructions on the enclosed WHITE proxy card to vote via the Internet. Only stockholdersyour latest dated proxy will count.

PLEASE NOTE THAT THIS YEAR, YOUR PROXY CARD LOOKS DIFFERENT. IT HAS MORE NAMES ON IT THAN THERE ARE SEATS UP FOR ELECTION, UNDER NEW REGULATIONS REQUIRING A “UNIVERSAL PROXY CARD.” THIS MEANS THE COMPANY’S PROXY CARD IS REQUIRED TO LIST JANA’S NOMINEES IN ADDITION TO THE COMPANY’S NOMINEES. PLEASE MARK YOUR CARD CAREFULLY AND ONLY VOTE “FOR” THE COMPANY’S NOMINEES AND PROPOSALS AS RECOMMENDED BY YOUR BOARD.

If you have any questions or need any assistance in voting your shares, please contact our proxy solicitor:

Morrow Sodali LLC

509 Madison Avenue, Suite 1206

New York, NY 10022

Banks and Brokers Call: (203) 561-6945

Stockholders Call Toll-Free: (800) 662-5200

E-mail: FRPT@investor.morrowsodali.com

We thank you for your continued support of record asFreshpet and look forward to your participation at our Annual Meeting.

By Order of the closeBoard of business on that date are entitled to receive notice of, to attend, and to vote at the Annual Meeting and any postponements or adjournments thereof.Directors,

Walter N. George III

[•], 2023

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON OCTOBER 3, 2022

The Company’s Notice of Annual Meeting, Proxy Statement and 2021 Annual Report to stockholders

for the fiscal year ended December 31, 2022 are currently available ononline free of charge in the Internet“Financial Information” subsection of Freshpet’s Investor Relations website at www.proxyvote.cominvestors.freshpet.com or at [•].

| | | | | |||

| | | TABLE OF CONTENTS | ||||

| | | |||||

| | | |||||

| | | |||||

| | | |||||

| | | |||||

| | | |||||

| | | |||||

| | | |||||

| | | |||||

| | | |||||

| | | |||||

| | | |||||

| | | |||||

| | | |||||

| | | |||||

| | | |||||

| | | |||||

| | | |||||

| | | |||||

| | | |||||

| | | |||||

| | | |||||

| | | |||||

This proxy statement (the “Proxy Statement”) and the accompanying form of proxy were first mailed to stockholders of record on or about [•], 2023. An annual report for the year ended December 31, 2022 (our “Annual Report”) is enclosed with this Proxy Statement. Electronic copies of this Proxy Statement and Annual Report are available at [•] and investors.freshpet.com.

In this Proxy Statement, we may make forward-looking statements regarding future events or the future financial performance of the Company. We use words such as “aim,” “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “outlook,” “potential,” “project,” “projection,” “plan,” “target,” “intend,” “seek,” “predict,” “goal,” “will,” “may,” “likely,” “should,” “would,” “could” (and the negative of any of these terms) and similar expressions to identify forward-looking statements. In addition, any statements that refer to projectionsFreshpet, Inc. as “Freshpet,” the “Company,” “we,” and “us” (as the context requires), the Company’s Board of our future financial performance, trends in our businessDirectors as the “Board,” the Company’s common stock, par value $0.001 per share, as the “Common Stock,” and the Company’s 2023 Annual Meeting of Stockholders, including any adjournments, postponements, or industry, uncertain events and assumptions, suchcontinuations thereof, as our ability to implement our future corporate governance plans described herein and our ability to meet our sustainability targets, goals, and commitments, including due to the impact of climate change, and other characterizations of future events or circumstances are forward-looking statements. These forward-looking statements are not guarantees of future performance and reflect management’s current expectations. Our actual results could differ materially from those discussed in such forward-looking statements. Please refer to our annual and quarterly reports on Form 10-K and Form 10-Q, respectively, for a discussion of important factors that could cause actual events or actual results to differ materially from those discussed in this Proxy Statement. These forward-looking statements speak only as of the date of this Proxy Statement, and we assume no obligation to revise or update any forward-looking statement for any reason, except as required by law.“Annual Meeting.”

This summary highlights information contained elsewhere in this proxy statementProxy Statement about Freshpet, Inc. and the upcoming 2022 annual meeting of stockholders.Annual Meeting. This summary does not contain all the information you should consider in deciding how to vote your shares. Stockholders should read the entire proxy statementProxy Statement before voting. In

Time and Date: | | | [•], October [•], 2023 at [•] a./p.m Eastern Time |

Place: | | | Via live webcast by visiting [•] |

Record Date: | | | The close of business on August 18, 2023 |

Attendance and Participation at the Annual Meeting: | | | Stockholders as of the Record Date will be able to attend the virtual Annual Meeting by visiting the link above, where you will be able to listen to the meeting live, submit questions, and vote. To participate in the Annual Meeting, you must pre-register at [•] by [•] p.m. Eastern Time on [•], 2023. More information on attending the Annual Meeting can be found in this Proxy Statement. |

Voting: | | | YOUR VOTE IS VERY IMPORTANT. Whether or not you plan to attend the Annual Meeting, we hope you will vote as soon as possible by following the instructions on the enclosed WHITE proxy card so that your shares are represented and your voice is heard. Returning the proxy does not deprive you of your right to attend the Annual Meeting and to vote your shares at the Annual Meeting. Stockholders of record as of the close of business on the Record Date are entitled to notice of, and to vote at, the Annual Meeting. Such stockholders are urged to submit an enclosed WHITE proxy card, even if their shares were sold after such date. More information on voting your WHITE proxy card and attending the Annual Meeting can be found in this Proxy Statement and the instructions on the WHITE proxy card. |

We urge you to VOTE TODAY by: INTERNET: [•] MAIL: complete and return the enclosed WHITE proxy card in the postage-paid envelope |

| | | Proposal | | | Board Recommendation | |

1 | | | Election of Directors To elect four Class III directors to the Board. Each of the director nominees is standing for election for a two-year term ending at the 2025 annual meeting of stockholders (the “2025 Annual Meeting”) and until his or her successor has been duly elected and qualified, or until such director’s earlier death, resignation or removal. | | | FOR each of the Company Nominees, Olu Beck, William B. Cyr, Leta D. Priest, and David J. West |

2 | | | Ratification of the Appointment of KPMG LLP as Our Independent Registered Public Accounting Firm for 2023 To ratify the selection of KPMG LLP (“KPMG”) as our independent registered public accounting firm for the fiscal year ending December 31, 2023. | | | FOR |

3 | | | Non-Binding Advisory Vote to Approve Executive Compensation To approve, on a non-binding advisory basis, the compensation of the named executive officers as disclosed in this Proxy Statement. The Board will review the results and take them into consideration when making future decisions regarding executive compensation. | | | FOR |

Proxy Statement we refer to Freshpet, Inc. as “Freshpet,” the “Company,” “we,” “our” or “us,” as the context requires.Summary| 2

| | | | | | | | | | | COMMITTEES | ||||||||||||||

NAME | | | AGE | | | CLASS | | | APPOINTED | | | CURRENT TERM EXPIRES | | | AUDIT | | | NOMINATING, GOVERNANCE & SUSTAINABILITY | | | COMPENSATION | | | OPERATIONS OVERSIGHT |

DIRECTOR NOMINEES | | | | | | | | | | | | | | | | | ||||||||

William B. Cyr Chief Executive Officer | | | 60 | | | III | | | Sept 2016 | | | 2023 | | | | | | | | | ||||

Olu Beck | | | 57 | | | III | | | Oct 2019 | | | 2023 | | | | | | |  | | | |||

Leta D. Priest | | | 64 | | | III | | | Sept 2018 | | | 2023 | | | | | | |  | | |  | ||

David J. West | | | 60 | | | III | | | July 2023 | | | 2023 | | |  | | | | | | | |||

CONTINUING DIRECTORS | | | | | | | | | | | | | | | | | ||||||||

David B. Biegger | | | 64 | | | I | | | May 2023 | | | 2024 | | |  | | | | | | |  | ||

Daryl G. Brewster | | | 66 | | | I | | | Jan 2011 | | | 2024 | | | | | | |  | | | |||

Jacki S. Kelley | | | 56 | | | I | | | Feb 2019 | | | 2024 | | | | |  | | | | | |||

Lawrence S. Coben, Ph.D. | | | 65 | | | II | | | Nov 2014 | | | 2025 | | | | |  | | | | | |||

Walter N. George III | | | 66 | | | II | | | Nov 2014 | | | 2025 | | | | |  | | | | |  | ||

Craig D. Steeneck | | | 65 | | | II | | | Nov 2014 | | | 2025 | | |  | | | | | | |  | ||

BOARD OF DIRECTORS SKILL MATRIX | | | ||||||||||||||||||||||||||||

SKILL OR EXPERIENCE | | | Olu Beck | | | David Biegger | | | Daryl Brewster | | | Lawrence Coben | | | Billy Cyr | | | Walt George | | | Jacki Kelley | | | Leta Priest | | | Craig Steeneck | | | David West |

Executive Leadership | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ |

Consumer Packaged Goods (“CPG”) | | | ✔ | | | ✔ | | | ✔ | | | | | | ✔ | | | ✔ | | | | | ✔ | | | ✔ | | | ✔ | |

Business Growth and Innovation | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ |

Corporate Governance and ESG | | | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | | | ✔ | | | ✔ | ||

Financial or Accounting | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | | | | | | | ✔ | | | ✔ | |||

Retail Experience | | | ✔ | | | ✔ | | | ✔ | | | | | ✔ | | | ✔ | | | | | ✔ | | | ✔ | | | ✔ | ||

Human Capital Management | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | | | | | ✔ | ||

Marketing | | | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | | | ✔ | | | ✔ | | | | | ✔ | |||

Manufacturing and Supply Chain | | | | | ✔ | | | ✔ | | | | | ✔ | | | ✔ | | | | | | | ✔ | | | ✔ | ||||

Public Company Board | | | ✔ | | | | | | ✔ | | | ✔ | | | | | | | | | | | ✔ | | | ✔ | ||||

Pet Food Experience | | | ✔ | | | | | ✔ | | | | | ✔ | | | ✔ | | | | | | | | | ✔ | |||||

Diverse | | | ✔ | | | | | | | | | | | | | ✔ | | | ✔ | | | | | |||||||

Includes Company Nominees and Continuing Directors. For definitions of Directors”each of the above skills or the “Board”) of Freshpet, Inc., a Delaware corporation (the “Company” or “Freshpet”), for use at the 2022 Annual Meeting of Stockholders (the “Annual Meeting”), which will be a hybrid meeting held both in-person and via simultaneous live webcast on October 3, 2022 at 8:00 a.m. Central Time.

Proxy Statement Summary| 5

STOCKHOLDER RIGHTS |

INDEPENDENT, NON-EXECUTIVE CHAIR |

The positions of Chair of the Board and Chief Executive Officer are presently separated. While our Amended and Restated Bylaws (the “Bylaws”) and Corporate Governance Guidelines do not require that our Chair and Chief Executive Officer positions be separate, we believe that separating these positions allows our Chief Executive Officer to focus on our day-to-day business and our Chair of the Board to lead the Board in its fundamental role of providing advice to and independent oversight of management. |

BOARD AND COMMITTEE INDEPENDENCE |

During 2022, all of our directors (other than our Chief Executive Officer) were independent, and each of our Board committees consisted entirely of independent directors. |

BOARD REFRESHMENT & COMMITMENT TO DIVERSITY |

Over the course of 2018 and 2019, the Board appointed three new directors, all of whom are female. In 2023, we appointed David B. Biegger and David J. West to our Board, and announced the retirement of our former Board Chair, Charles A. Norris, consistent with our director retirement policy, with Walter N. George, III, previously the Chair of the Nominating, Governance & Sustainability Committee, becoming Board Chair. We believe that fresh perspectives and diversity, in its many forms, and the breadth of perspective that it brings, enhance the effectiveness of the Board. |

3 in 10 directors are diverse (includes gender and ethnic diversity) |

SINGLE VOTING CLASS |

All holders of Freshpet’s Common Stock have the same voting rights (one vote per share of stock). |

NO POISON PILL |

The Company has not adopted a stockholder rights plan, also known as a poison pill. |

STOCKHOLDER ENGAGEMENT |

SINCE OUR 2022 ANNUAL MEETING AND SO FAR IN 2023… |

Since last year’s annual meeting of stockholders, we have met and engaged directly with stockholders holding approximately 84% of our outstanding Common Stock, and additional outreach is underway. |

Members of our Board and management have also: • Met with analysts who cover our Company and leading proxy advisors who serve our investors • Presented at six industry conferences • Held seven non-deal road shows • Hosted numerous investors on tours of the Freshpet Kitchens, where investors and analysts heard presentations from our senior management about all aspects of our business |

Questions and Answers About the Annual Meeting| 6

WHY AM I RECEIVING THIS PROXY STATEMENT? WHO IS SOLICITING PROXIES FOR THE ANNUAL MEETING WITH THIS PROXY STATEMENT?

You are receiving this Proxy Statement and the enclosed WHITE proxy card because you were a holder of our Common Stock as of the Record Date, and the Board is soliciting your proxy to vote your shares of our Common Stock on all matters scheduled to come before the Annual Meeting, whether or not you attend the Annual Meeting.

Members of the Board and certain officers of the Company are “participants” with respect to the Company’s solicitation of proxies in connection with the Annual Meeting (each such person, a “Participant”). For more information on the Participants in the Board’s solicitation, please see “Additional Information Regarding Participants in the Solicitation” in Appendix A to this Proxy Statement.

WHO IS JANA PARTNERS? HOW ARE THEY INVOLVED IN THE ANNUAL MEETING?

On May 25, 2023, the Company received notice from JANA Partners, LLC (together with its affiliates and associates, “JANA”), an activist hedge fund, stating its intention to nominate three candidates for election to the Board at the Annual Meeting, as well as an alternate director nominee in the event the Board increased the size of the Board to elect more than three directors at the Annual Meeting or if more than three directors are to be elected at the Annual Meeting for any other reason (collectively, the “JANA Nominees”). On June 8, 2023, the Company announced that it would be postponing the Annual Meeting to a later date and that it would also open a fourth director seat for election at the Annual Meeting. You may receive proxy solicitation material from JANA, including a green proxy card. The Company is not responsible for the accuracy of any information contained in any proxy solicitation materials filed or disseminated by, or on behalf of, JANA or any other statements that JANA may otherwise make. For more information on the Company’s engagement with JANA, please see “Background to the Solicitation” on page [•] of this Proxy Statement.

OUR BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” EACH OF OUR BOARD’S NOMINEES BY USING THE ENCLOSED WHITE PROXY CARD AND DISREGARD ANY MATERIALS, AND DO NOT SIGN, RETURN OR VOTE ON ANY GREEN PROXY CARD, SENT TO YOU BY OR ON BEHALF OF JANA.

While you may use JANA’s green proxy card to vote for the Company Nominees, we encourage you to instead vote “FOR” each of our four Company Nominees under Proposal 1 and “FOR” each of Proposals 2 and 3 on the universal WHITE proxy card by Internet or by completing, signing, dating and returning the enclosed WHITE proxy card in the postage-paid envelope provided or by voting virtually at the Annual Meeting. While we encourage stockholders to send only our WHITE proxy card, in the event a stockholder returns multiple proxy cards, only the latest-dated proxy card submitted will count.

WHAT MATTERS AM I VOTING ON? HOW DOES THE BOARD RECOMMEND THAT I VOTE ON THESE MATTERS?

Proposal 1: Election of Directors

The Board is asking stockholders to elect four Class III directors to the Board. Each of the director nominees is standing for election for a term ending at the 2025 Annual Meeting and until his or her successor has been duly elected and qualified, or until such director’s earlier death, resignation or removal.

The Board has nominated and unanimously recommends the election of four incumbent directors (the “Company Nominees”). For more information on the Company Nominees, please see “Directors, Executive Officers, and Corporate Governance – Director Nominees” on page [•] of the Proxy Statement. You may vote for each of these four director candidates on the enclosed universal WHITE proxy card.

The Board unanimously recommends that stockholders vote “FOR” each of the Company Nominees on the WHITE proxy card.

Questions and Answers About the Annual Meeting| 7

Proposal 2: Ratification of the Appointment of Our Independent Registered Public Accounting Firm for 2023

Stockholders are being asked to ratify the selection of KPMG LLP (“KPMG”) as our independent registered public accounting firm for the fiscal year ending December 31, 2023.

The Board unanimously recommends that stockholders vote “FOR” the ratification of KPMG as our independent registered public accounting firm for 2023.

Proposal 3: Non-Binding Advisory Vote to Approve Executive Compensation (“Say-on-Pay”)

The Board is asking stockholders to approve, on a non-binding advisory basis, the compensation of the named executive officers as disclosed in this Proxy Statement (also known as “Say-on-Pay”). As an advisory vote, the result will not be binding on the Board or the Compensation Committee. This “Say-on-Pay” vote will, however, provide us with important feedback from our stockholders about our executive compensation philosophy, objectives and program. The Board and the Compensation Committee value the opinions of our stockholders and expect to take into account the outcome of the vote when considering future executive compensation decisions and when evaluating the Company’s executive compensation program.

The Board unanimously recommends that stockholders vote “FOR” the approval of executive compensation on an advisory basis.

HOW DO I VOTE?

If you are a registered stockholder (that is, you hold shares in your name directly on the books of our transfer agent, Computershare Trust Company, N.A. (“Computershare”), and not through a bank, broker or other nominee) you may choose either of two methods to submit your proxy to have your shares voted in advance of the Annual Meeting:

| • | Internet: You may submit your proxy online via the Internet by accessing the following website and following the instructions provided: [•]. You may navigate to the online voting site by entering your 8-digit control number found on the enclosed WHITE proxy card. After receiving printed copies of the proxy materials, have your proxy card ready when you access the site and follow the prompts to record your vote. This vote will be counted immediately and there is no need to mail in any proxy card you may have received. |

| • | Mail: If you received your Annual Meeting material by mail, you also may choose to grant your proxy by completing, signing, dating and returning the enclosed WHITE proxy card. |

If you are the beneficial owner of shares (that is, you held your shares in “street name” through an intermediary such as a broker, bank or other nominee) as of the Record Date, you will receive instructions from your broker, bank or other nominee as to how to vote your shares or submit a proxy to have your shares voted. PLEASE USE THE VOTING FORMS AND INSTRUCTIONS PROVIDED BY YOUR BROKER, BANK OR OTHER NOMINEE. In most cases, you will be able to do this by mail or via the Internet. As discussed herein, your broker, bank or other nominee may not be able to vote your shares on any matters at the Annual Meeting unless you provide instructions on how to vote your shares. You should instruct your broker, bank or other nominee how to vote your shares by following the directions provided by your broker, bank or other nominee.

PLEASE NOTE THAT THIS YEAR, YOUR PROXY CARD LOOKS DIFFERENT. IT HAS MORE NAMES ON IT THAN THERE ARE SEATS UP FOR ELECTION, UNDER NEW REGULATIONS REQUIRING A “UNIVERSAL PROXY CARD” WHICH ARE DESCRIBED IN MORE DETAIL BELOW. THIS MEANS THE COMPANY’S PROXY CARD IS REQUIRED TO LIST JANA’S NOMINEES IN ADDITION TO THE COMPANY’S NOMINEES. PLEASE MARK YOUR CARD CAREFULLY AND ONLY VOTE “FOR” EACH OF THE COMPANY’S NOMINEES AND PROPOSALS AS RECOMMENDED BY YOUR BOARD. WE ENCOURAGE YOU TO VOTE BY INTERNET TO AVOID POTENTIAL CONFUSION WITH THE UNIVERSAL PROXY CARD. YOU SHOULD ONLY VOTE FOR FOUR NOMINEES TOTAL.

Alternatively, you may vote at the virtual Annual Meeting. The Annual Meeting will be held online via a live webcast at [•]. You may only participate in the virtual meeting by registering in advance at [•] prior to the deadline of [•] Eastern Time on [•], 2023. Please have your voting instruction form, proxy card or other communication containing

Questions and Answers About the Annual Meeting| 8

your control number available and follow the instructions to complete your registration request. If you are a beneficial holder, you must obtain a “legal proxy” from your broker, bank or other nominee to participate in and vote during the Annual Meeting. Upon completing registration, participants will receive further instructions via email that will allow them to access the meeting.

Even if you plan to attend the virtual Annual Meeting, we encourage you to vote your shares on the WHITE proxy card TODAY by Internet or mail to ensure that your votes are counted at the Annual Meeting.

WHAT IS A PROXY? WHAT SHARES ARE INCLUDED ON A PROXY CARD?

A proxy is your legal designation of another person to vote the stock you own. That other person is called a proxy. If you designate someone as your proxy in a written document, that document is also called a proxy or a proxy card. Our Board has designated [•] and [•] as the Company’s proxies for the Annual Meeting.

Each proxy or voting instruction card represents the shares registered to you as of the close of business on the Record Date. You may receive more than one proxy or voting instruction card if you hold your shares in multiple accounts, some of your shares are registered directly in your name with the Company’s transfer agent, or some of your shares are held in street name through a broker, bank or other nominee. Please vote the shares on each WHITE proxy card or voting instruction card to ensure that all of your shares are counted at the Annual Meeting.

CAN I CHANGE MY VOTE OR REVOKE MY PROXY?

Yes. If your shares are registered directly in your name, you may change your vote or revoke your proxy by:

Delivering written notice of revocation to the Corporate Secretary at 400 Plaza Drive, 1st Floor, Secaucus, NJ 07094 that is received on or before [•] p.m. Eastern Time on [•], 2023;

Delivering a properly executed proxy card bearing a later date than the proxy that you wish to revoke;

Submitting a later dated proxy over the Internet in accordance with the instructions on the proxy card; or

Voting Rights, Quorumyour shares electronically during the Annual Meeting.

If your shares are held in street name, you should contact your broker, bank or other nominee directly to change your vote or revoke your proxy.

If you have previously submitted a green proxy card sent to you by JANA, you may change your vote by completing, signing, dating and Required Votereturning the enclosed WHITE proxy card in the postage-paid envelope provided, or by voting via the Internet or by following the instructions on the WHITE proxy card. Please note that submitting a green proxy card sent to you by JANA will revoke votes you have previously made via the Company’s WHITE proxy card.

WHO IS ENTITLED TO VOTE? HOW MANY SHARES ARE OUTSTANDING? HOW MANY VOTES DO I HAVE?

Only holders of record of our common stockCommon Stock at the close of business on August 9, 2022,18, 2023, which is the record date,Record Date, will be entitled to receive notice of, to attend, and to vote at the Annual Meeting and any postponements or adjournments thereof.Meeting. At the close of business on August 9, 2022, we had [47,820,427]the Record Date, [•] shares of common stockour Common Stock were outstanding and entitledeligible to vote.be voted. Holders of the Company’s common stockCommon Stock are entitled to one vote for each share held as of the above record date. A quorumRecord Date. Cumulative voting is requirednot permitted in the election of directors.

WHAT IS THE DEADLINE FOR VOTING?

The deadline for ourvoting by Internet is 11:59 p.m. Eastern Time on October [•], 2023. Votes cast by mail must be received no later than the start of the Annual Meeting. If you attend the Annual Meeting, you may vote your shares electronically during the meeting.

IF I CAN’T ATTEND THE ANNUAL MEETING, CAN I VOTE LATER?

We encourage stockholders to conduct businessvote and submit their proxy in advance of the Annual Meeting by one of the methods described in the proxy materials, regardless of whether you think you will be able to attend the Annual Meeting. Any votes submitted after the closing of the polls at the Annual Meeting.Meeting will not be counted.

Questions and Answers About the Annual Meeting| 9

WHAT CONSTITUTES A QUORUM?

Freshpet is incorporated in the State of Delaware. As a result, the Delaware General Corporation Law (the “DGCL”) and our Amended and Restated Bylaws (the “Bylaws”) govern the voting standards applicable to actions taken by our stockholders. The holders of a majority in voting power of all issued and outstanding stock entitled to vote at the Annual Meeting, present at the Annual Meeting or represented by proxy, will constitute a quorum for the transaction of business at the Annual Meeting.Meeting, and business may not be conducted at the Annual Meeting unless a quorum is present. If there are not sufficient shares present or represented by proxy at the Annual Meeting to constitute a quorum for approval of any matter to be voted upon, the Annual Meeting may be adjourned to permit further solicitation of proxies in order to achieve a quorum. Abstentions or withheld votes and “broker non-votes” (described below) will beare counted inas shares present and entitled to vote for the purpose of determining whether therea quorum is a quorum.present.

Proposal | | | Voting Standard | | | Board Recommendation | | | Effect of Abstentions and Withholds | | | Effect of Broker Non-Votes |

Proposal No. 1 Election of Four Class III Directors to the Board | | | Plurality of votes cast, meaning that the four nominees receiving the most votes “FOR” their election will be elected to the Board. | | | FOR each of the COMPANY NOMINEES: Olu Beck, William B. Cyr, Leta D. Priest, and David J. West | | | Withhold votes have no effect on the outcome of the election of directors. | | | Broker discretionary voting is not permitted, and broker non-votes will have no effect on the outcome of this proposal. |

Proposal No. 2 Ratification of Appointment of KPMG as Our Independent Registered Public Accounting Firm for 2023 | | | Majority of shares present in person or by proxy and entitled to vote on the matter. | | | FOR | | | Abstentions have the same effect as a vote against the proposal. | | | Broker discretionary voting is not permitted, and broker non-votes will have no effect on the outcome of this proposal. |

Proposal No. 3 Non-Binding Advisory Vote to Approve Executive Compensation (“Say-on-Pay”) | | | Majority of shares present in person or by proxy and entitled to vote on the matter. | | | FOR | | | Abstentions have the same effect as a vote against the proposal. | | | Broker discretionary voting is not permitted, and broker non-votes will have no effect on the outcome of this proposal. |

Under our Bylaws, when a quorum is present at any meeting of stockholders, in all matters other than the election of directors, the affirmative vote of a majority of the shares present in person or represented by proxy at the meeting and entitled to vote on the subject matter is required to approve such matter, subject to certain exceptions governed by law or regulation, such as the DGCL. Under the DGCL, with respect to Proposal No. 4, the affirmative vote of a majority of the outstanding stock entitled to vote thereon is required to approve such matter.

Pursuant to our Bylaws, in an uncontested election of directors, such as that being held at our Annual Meeting this year, directors are elected by majority of the votes cast. For purposes of the Bylaws, in an uncontested election, as is the case this year, a “majority of the votes cast” means that the number of shares voted “for” a director must exceed the number of votes cast “against” that director (with “abstentions” and “broker non-votes” not counted as a vote cast either “for” or “against” that director’s election). Abstentions and broker non-votes will have no impact on the outcome of Proposal No. 1, as they are not considered votes cast for this purpose.

10

OUR BOARD UNANIMOUSLY RECOMMENDS VOTING “FOR” THE ELECTION OF EACH OF OUR BOARD’S NOMINEES ON PROPOSAL 1 AND “FOR” PROPOSALS 2 AND 3 USING THE ENCLOSED WHITE PROXY CARD.

WHAT IS A BROKER NON-VOTE?

If your shares are held in “street name” through(that is, held for your account by a broker, bank broker or other nominee,nominee), you will receive voting instructions from your broker, bank or other nominee. If you are a street name holder and your shares are registered in the name of a broker, the New York Stock Exchange rules applicable to brokers who have record ownership of listed company stock (including stock such as ours that is listed on The Nasdaq Global Market) determine whether your broker may vote your shares in its discretion even if it does not receive voting instructions from you. If you are a street name holder and a broker provides you with competing proxy materials from JANA (in addition to the Company’s proxy materials), none of the matters before the Annual Meeting will be considered discretionary, and therefore the beneficial ownerbroker may not vote your shares with respect to any of those shares. You maythe proposals to be ablevoted on at the Annual Meeting unless you provide the broker with voting instructions. These “broker non-votes” will be included in the calculation of the number of votes considered to votebe present at the meeting for the purpose of determining a quorum, but will not be counted in determining the number of shares necessary for the approval of the proposals.

HOW WILL SHARES BE VOTED ON THE UNIVERSAL WHITE PROXY CARD?

The shares represented by telephoneany WHITE proxy card that is properly completed, executed and received by the Company prior to or electronically throughat the InternetAnnual Meeting will be voted in accordance with the voting instructions providedspecifications made on the card, whether it is returned by that nominee. You must obtainmail or Internet.

If you return a legalvalidly executed and dated WHITE proxy from the nominee that holdscard without indicating how your shares ifshould be voted on a matter and you wishdo not revoke your proxy, your proxy will be voted: “FOR” the election of all four director nominees recommended by our Board as set forth on the WHITE proxy card (Proposal 1); “FOR” the ratification of the appointment of KPMG as our independent registered public accounting firm for fiscal year 2023 (Proposal 2); and “FOR” the approval, on an advisory basis, of the compensation paid to our named executive officers, as disclosed in this Proxy Statement (commonly known as a “Say-on-Pay resolution”) (Proposal 3).

Our Board is not aware of any matters that are expected to come before the Annual Meeting other than those described in this Proxy Statement. If any other matter is presented at the Annual Meeting upon which a vote in-person or viamay be properly taken, shares represented by all WHITE proxy cards received by the InternetCompany will be voted with respect thereto at the discretion of the persons named as proxies on the enclosed WHITE proxy card.

WILL MY SHARES BE VOTED IF I DO NOTHING?

No. If you are a registered stockholder of record (i.e., you own your shares directly on the books of the Company’s transfer agent, Computershare, and not through a broker) and you do not cast your vote, no votes will be cast on your behalf on any of the items of business at the Annual Meeting.

If your shares are held in more than one account, you will receive more than one universal WHITE proxy card, and in that case, you can and are urged to vote all of your shares by completing, signing, dating and returning all universal WHITE proxy cards you receive from the eventCompany in the postage-paid envelope provided. If you choose to vote via the Internet, please vote using each universal WHITE proxy card you receive to ensure that sufficient votes in favorall of your shares are voted. Only your latest dated proxy for each account will count. Please sign each proxy card exactly as your name or names appear on the proposals are not received byproxy card. For joint accounts, each owner should sign the date ofproxy card. When signing as an executor, administrator, attorney, trustee, guardian or other representative, please print your full name and title on the Annual Meeting,proxy card.

If JANA proceeds with its previously announced proxy solicitation, the Chairman of the Annual Meeting may adjournCompany will likely conduct multiple mailings prior to the Annual Meeting to permit further solicitations of proxies.

11

You may receive proxy solicitation materials from JANA. Our Board strongly urges you NOT to sign or return any green proxy card sent to you by JANA. While you may vote for the Company’s Nominees on either the Company’s proxy card or JANA’s proxy card, we still strongly encourage you to use the universal WHITE proxy card to vote your shares, regardless of how you intend to vote.

If you have previously submitted a proxy card sent to you by JANA, you can revoke it and vote “FOR” each of the director nominees recommended by our Board by completing, signing, dating, and returning the enclosed WHITE proxy card in the postage-paid envelope provided, or by following the instructions on the WHITE proxy card to vote via the Internet. Only the latest validly executed proxy that you submit will be counted, and any solicitation of proxiesproxy may be revoked at any time prior to be votedits exercise at the Annual Meeting as described above. If you attend and validly vote at the Annual Meeting, your previously submitted proxy will not be used.

Our Board unanimously recommends using the enclosed universal WHITE proxy card to vote “FOR” each of our Board’s four nominees. Our Board recommends that you DISREGARD any green proxy cards that you may receive.

HOW MANY SEATS ON THE BOARD ARE UP FOR ELECTION AT THE ANNUAL MEETING? WHY IS NEW DIRECTOR DAVID B. BIEGGER NOT UP FOR ELECTION?

There are four seats on the Board up for election at the Annual Meeting.

The Board currently has 10 members divided into three classes with staggered terms. As part of the Company's previously announced governance reforms, which are discussed in more detail beginning on page [•] of this Proxy Statement, the Company is in the process of declassifying the Board, which will be paidcomplete by 2025. This year, the Company. Class III directors of the Board are up for election, the Class having previously been elected to a three-year term at our 2020 annual meeting of stockholders (the “2020 Annual Meeting”). One of the Class III directors, David J. West, joined our Board on July 21, 2023, upon the retirement of former Class III director and Board Chair Charles A. Norris. For more information on the Board of Directors, please see “Board of Directors” on page [•] of this Proxy Statement.

Consistent with the requirements of the Company’s Sixth Amended and Restated Certificate of Incorporation (its “Certificate of Incorporation”) that the classes of directors be as nearly equal in size as is practicable, upon his appointment on May 17, 2023, David B. Biegger was added to Class I, which only had two directors prior to his appointment to the Board (whereas Class II and Class III each had four directors). Because only Class III directors are up for election this year, David B. Biegger is not up for election at the 2023 Annual Meeting, but will instead stand for election next year at the 2024 annual meeting of stockholders (the “2024 Annual Meeting”).

This approach to balancing our Board’s classes is consistent with the requirements of our Certificate of Incorporation. Once Freshpet finishes the process of declassifying its Board, all directors will be up for election at the 2025 Annual Meeting and each year thereafter.

WHY DID THE COMPANY POSTPONE THE ANNUAL MEETING?

The Company first became aware of JANA’s investment in Freshpet on September 22, 2022, when JANA publicly disclosed both its ownership interest and its agreement with three individuals to be nominated as directors at the 2023 Annual Meeting. In the interest of resolving JANA’s campaign and avoiding continued distraction, the Company had initially announced that the 2023 Annual Meeting would be held in July to allow stockholders to express their views on an expedited basis. However, JANA commenced litigation challenging the timing of the meeting and the placement of the directors, which made holding the Annual Meeting in July unfeasible. As a result, the Company announced that it would postpone the 2023 Annual Meeting to a date in October, a similar time period as last year.

Questions and Answers About the Annual Meeting| 12

While this postponement was not required, the Board decided that the postponement would be the most practical path forward in light of JANA’s actions. For more information, please see “Background to the Solicitation” on page [•] of this Proxy Statement.

WHAT HAPPENS IF JANA WITHDRAWS OR ABANDONS ITS SOLICITATION OR FAILS TO COMPLY WITH THE NEW RULES AND I ALREADY GRANTED PROXY AUTHORITY IN FAVOR OF JANA?

Stockholders are encouraged to submit their votes on the universal WHITE proxy card. If JANA withdraws or abandons its solicitation or fails to comply with the universal proxy rules after a stockholder has already granted proxy authority, stockholders can still sign and date a later submitted universal WHITE proxy card. If JANA withdraws or abandons its solicitation or fails to comply with the universal proxy rules, then any votes cast in favor of JANA’s Nominees will be disregarded and not be counted, whether such vote is provided on the Company’s universal WHITE proxy card or on JANA’s green proxy card.

WHAT IS A UNIVERSAL PROXY? WILL IT BE USED IN CONNECTION WITH THE ANNUAL MEETING?

The SEC recently adopted Rule 14a-19 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), commonly referred to as the “universal proxy rules,” requiring the use of a universal proxy card in contested director elections that take place after August 31, 2022. This means that all of the Company’s nominees and any dissident nominees will be listed on each proxy card that is sent to stockholders in connection with a contested meeting. Stockholders may vote for nominees from either or both of the Company’s slate and the dissident slate, but in any event may not vote for more nominees than there are seats available to be filled. Even though we are required to include the JANA Nominees on our universal WHITE proxy card, it does not mean that we recommend voting for them. Your Board is ONLY recommending that stockholders vote for the four Company Nominees, Olu Beck, William B. Cyr, Leta D. Priest and David J. West.

Because an affiliate of JANA has provided notice of its intent to nominate candidates for election to the Board at the Annual Meeting, this year’s director elections are considered contested, and a universal proxy card will be used. While you may vote for the Company’s nominees on either the Company’s proxy card or JANA’s proxy card, we still strongly encourage you to use the universal WHITE proxy card to vote your shares, regardless of how you intend to vote.

WHAT HAPPENS IF I RETURN A UNIVERSAL PROXY CARD BUT GIVE VOTING INSTRUCTIONS FOR MORE THAN FOUR CANDIDATES?

An “over-vote” occurs when a stockholder submits more votes “FOR” director nominees than there are Board seats up for election. To the extent an over-vote (e.g., voting “FOR” with respect to more than four nominees on Proposal 1) occurs on a record holder’s universal proxy card and it is not corrected, all of such record holder’s votes on Proposal 1 regarding nominees will be invalid and will not be counted. In addition, depending on the broker, bank, or other nominee through which you hold your shares, your votes on all other proposals before the Annual Meeting may also be invalid and not counted. We encourage you to vote by Internet to avoid an “over-vote.”

WHAT HAPPENS IF I RETURN A UNIVERSAL PROXY CARD BUT GIVE VOTING INSTRUCTIONS FOR FEWER THAN FOUR CANDIDATES?

An “under-vote” occurs when a stockholder submits fewer votes “FOR” director nominees than there are director seats up for election. To the extent an under-vote (i.e., voting “FOR” with respect to fewer than four nominees on Proposal 1) occurs on any stockholder’s universal proxy card, your shares will only be voted “FOR” those nominees you have engaged Broadridge Financial Solutions, Inc. (“Broadridge”)so marked and “WITHHOLD” for the other nominees. We encourage you to vote by Internet to avoid an “under-vote.”

WHO MAY ATTEND THE ANNUAL MEETING? HOW DO I ATTEND THE ANNUAL MEETING?

The Annual Meeting will be held in a virtual-only format. You are entitled to participate in the Annual Meeting only if you were a holder of Common Stock as of the close of business on the Record Date, or your authorized representative or you hold a valid proxy for the Annual Meeting. Stockholders must pre-register in order to attend and vote by ballot at the Annual Meeting. Please see the section below “How do I participate in the Annual Meeting?” for instructions about how to pre-register.

Questions and Answers About the Annual Meeting| 13

Even if you plan to attend the Annual Meeting, please vote using the procedures described on your WHITE universal proxy card as soon as possible so that your vote will be counted if you later are unable or decide not to attend the Annual Meeting.

HOW DO I PARTICIPATE IN THE ANNUAL MEETING?

The Annual Meeting will be held online via a live webcast at [•]. You may only participate in the virtual Annual Meeting by registering in advance at [•] prior to the deadline of [•] Eastern Time on [•], 2023. Please have your voting instruction form, proxy card or other communication containing your 8-digit control number available and follow the instructions to complete your registration request. If you are a beneficial holder, you must obtain a “legal proxy” from your broker, bank or other nominee to participate in and vote during in the Annual Meeting. Upon completing registration, participants will receive further instructions via email that will allow them to access the meeting.

Stockholders may log into the meeting platform beginning at [•] Eastern Time on October [•], 2023. We encourage you to log in prior to the meeting start time. We will have a support team ready to assist attendees with any technical difficulties they may have accessing or hearing the preparation and distributionaudio webcast of the meeting.

Additional information and our proxy solicitation materials forcan also be found at [•]. If you have any difficulty following the registration process, please email FRPT@investor.morrowsodali.com or call (800) 662-5200.

MAY I SUBMIT QUESTIONS DURING THE ANNUAL MEETING?

Yes. We expect that members of the Board and management, as well as representatives of our independent registered public accounting firm, KPMG, will attend the Annual Meeting and be available to act as vote tabulator, at a base feeanswer stockholder questions. We will provide our stockholders the opportunity to ask questions. Questions submitted during the meeting pertinent to meeting matters will be answered during the meeting, subject to time constraints. Instructions for submitting questions and making statements will be posted on the virtual meeting website. This question and answer session will be conducted in accordance with certain Rules of $9,500, plus reimbursementConduct. These Rules of reasonable expenses. FollowingConduct will be posted on our investor relations website prior to the original mailingdate of the proxiesAnnual Meeting, and other soliciting materials,may include certain procedural requirements.

WHAT IF I EXPERIENCE TECHNICAL ISSUES WITH THE VIRTUAL MEETING PLATFORM?

We will have technicians ready to assist you with any technical difficulties you may have accessing the Companyvirtual meeting. If you encounter any difficulties accessing the virtual meeting during check-in or during the Annual Meeting, please call the technical support number that will be posted in the virtual meeting reminder email sent the day prior to the Annual Meeting. We encourage you to access the virtual meeting prior to the start time.

WHO WILL COUNT THE VOTES?

A representative from [•] will count the votes and its directors, officers or employees (for no additional compensation) may also solicit proxiesserve as the independent inspector of election for the Annual Meeting.

WHERE CAN I FIND THE RESULTS OF THE ANNUAL MEETING?

We will report the voting results of the Annual Meeting in person, by telephone or email. The Companya Current Report on Form 8-K filed with the SEC within four business days following our Annual Meeting, a copy of which will also be available on our website at investors.freshpet.com.

DO I HAVE ANY DISSENTERS’ OR APPRAISAL RIGHTS WITH RESPECT TO ANY OF THE MATTERS TO BE VOTED ON AT THE ANNUAL MEETING?

No. Delaware law does not provide stockholders any dissenters’ or appraisal rights with respect to the matters to be voted on at the Annual Meeting.

HOW DO I REQUEST A PAPER OR ELECTRONIC COPY OF THE PROXY MATERIALS?

A copy of our proxy materials, as filed with the SEC, is available, without charge, by mailing a request that banks, brokersto Investor Relations, Freshpet, Inc., 400 Plaza Drive, 1st Floor, Secaucus, NJ 07094, Attention: Corporate Secretary. The proxy materials are posted on our website at investors.freshpet.com and other nominees forward copiesare available free of charge from the SEC at its website, www.sec.gov.

Questions and Answers About the Annual Meeting| 14

WHOM DO I CONTACT IF I HAVE QUESTIONS ABOUT THE ANNUAL MEETING?

If you have any questions or need any assistance in voting your shares, please contact our proxy solicitor:

Morrow Sodali LLC

509 Madison Avenue, Suite 1206

New York, NY 10022

Banks and other soliciting materials to persons for whom they hold shares of common stock and request authority for the exercise of proxies. We will reimburse banks, brokers and other nominees for reasonable charges and expenses incurred in forwarding soliciting materials to their clients.Brokers Call: (203) 561-6945

Stockholders Call Toll-Free: (800) 662-5200

E-mail: FRPT@investor.morrowsodali.com

15

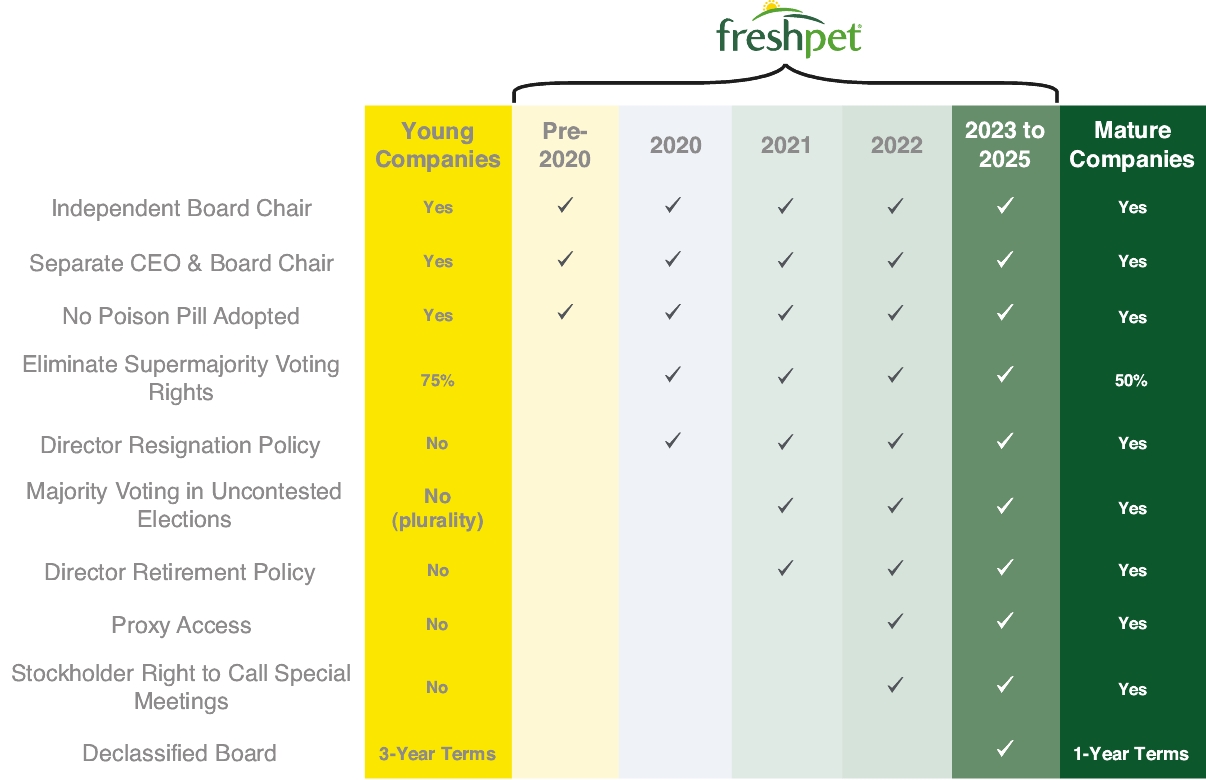

In 2020, the Board began implementing Freshpet’s “Commitment to Good Corporate Governance: 2020 to 2025 Roadmap” plan, which was developed in part based on feedback received from a broad range of Proxiesstockholders. For more information on this plan, please see page [•] of this Proxy Statement.

In the spring of 2022, the Board began its most recent board refreshment cycle with the goal of enhancing the Board’s composition in early 2023. The Board engaged a nationally recognized, independent third-party search firm to assist in the identification and evaluation of potential director candidates.

On September 7, 2022, the Company announced several organizational changes designed to enhance its capabilities and support its long-term growth objectives. These leadership changes included:

the resignation of Heather Pomerantz, the Company’s then CFO;

the appointment of Richard Kassar as interim CFO;

the retention of Steve Weise, then Executive Vice President of Manufacturing, in a consulting role, instead of his previously announced retirement;

the engagement of Jay Dahlgren, previously Vice President of Operations at J.M. Smucker Company, as a consultant to the Company;

the promotion of Ricardo Moreno to the position of Senior Vice President of Manufacturing & Engineering; and

the broadening of responsibilities of Michael Hieger in his role as Senior Vice President of Engineering.

On September 22, 2022, prior to the Company’s 2022 Annual Meeting and more than twelve months prior to the Annual Meeting, JANA, Diane Dietz, James Lillie, Timothy R. McLevish and other reporting persons filed a Schedule 13D (the “Schedule 13D”) with the SEC disclosing their beneficial ownership of 9.6% of the Company’s outstanding Common Stock and that JANA had identified three director candidates, Ms. Dietz, Mr. Lillie and Mr. McLevish, who had each agreed to become a JANA nominee for election to the Board at the Annual Meeting. JANA stated its intent to have discussions with Company management regarding a possible sale of the Company, Board composition and other governance matters and various other topics. The Company was not aware of JANA’s investment prior to JANA filing the Schedule 13D.

On September 30, 2022, Barron’s published a story detailing JANA’s interest in speaking with Company management. Citing “two people familiar with the situation,” the article asserted that the Company had hired bankers in response to JANA’s pressure on the Company to sell itself.

On October 3, 2022, the Company held its 2022 Annual Meeting.

On October 13, 2022, Craig D. Steeneck, a member of the Board, William B. Cyr, the Company’s CEO, Scott Morris, the Company’s President and COO, and Mr. Kassar had an initial conversation with Scott Ostfeld, Kevin Galligan, and other individuals from JANA. JANA’s overwhelming focus in the conversation was its demand that the Company initiate a strategic review with the goal of selling the entire Company, with JANA going so far as to identify potential buyers, with commentary on each of them. When asked what sale price would be acceptable, JANA stated that they would be pleased with a sale price in the high $70s per share and referenced what they believed were precedent situations at 7x sales, which would equate to a sales price for the Company in the high $70s per share. JANA indicated that it would permit the Company a few weeks to initiate such a process or else it would increase the pressure on the Company to do so.

Background to the Solicitation| 16

On November 1, 2022, the Company announced the appointment of Todd Cunfer as Chief Financial Officer, effective December 1, 2022, and the appointment of Dirk Martin as Vice President of Customer Service & Logistics, effective December 7, 2022.

On November 3, 2022, Mr. Cyr and Mr. Kassar had a conversation with Mr. Ostfeld and other representatives of JANA after the Company’s earnings call for the third quarter of 2022. Mr. Cyr and Mr. Kassar discussed the Company’s recent earnings results and stated that the Board was in the process of considering JANA’s perspectives.

In December of 2022, with the assistance of the director search firm, the Board identified David B. Biegger and David J. West as two potential director candidates. Mr. Biegger indicated that he would be available to join the Board immediately. Mr. West indicated he would not be available until such time that he no longer served as CEO and chairman of the board of Conyers Park III Acquisition Corp. (“Conyers Park”), a special purpose acquisition company that was ultimately dissolved in July 2023.

On December 9, 2022, JANA filed an amendment to its Schedule 13D disclosing sales of the Company’s Common Stock resulting in a decrease in ownership to 8.6% of the Company’s Common Stock and that Kurt T. Schmidt had been added as a potential JANA nominee for election to the Board at the Annual Meeting.

On December 14, 2022, Mr. Cyr and Mr. Ostfeld had a discussion about JANA’s recent Schedule 13D filing. During this discussion, Mr. Cyr asked if JANA had identified its final candidates for election to the Board at the Annual Meeting. Mr. Ostfeld responded that JANA might include a JANA representative.

During the CAGNY 2023 Conference of the Consumer Analyst Group of New York, which took place between February 20, 2023 and February 24, 2023, Mr. Cyr and Mr. Cunfer had conversations with Mr. Ostfeld regarding the Company and its industry, including the recently announced launch of a new competitive product from General Mills.

On February 26, 2023, the Board decided that Mr. Biegger should be appointed to the Board as soon as possible and intended to appoint Mr. West later in the year if and when he became available. While the Board could appoint Mr. Biegger immediately, given ongoing discussions with JANA, the Board decided to delay Mr. Biegger’s appointment in order to potentially include his appointment as part of a comprehensive settlement with JANA.

On February 27, 2023, the Company released its financial results for the fourth quarter of and full year 2022. In conversations with stockholders, the Company revisited prior comments about the importance of raising funds as part of its capacity expansion plan, and stockholders asked how this would be executed. During these conversations, Mr. Cunfer emphasized that the Company was focused on finding a path to raise capital and strengthen its balance sheet in a cost-efficient way.

On March 2, 2023, Mr. Cyr and Mr. Cunfer had a discussion with Mr. Ostfeld and Mr. Galligan about the Company’s earnings results and guidance. Mr. Galligan inquired whether the Company was considering a convertible debt offering and stated that such an offering would not be acceptable to JANA. Mr. Cunfer emphasized that the Company was focused on finding a path to strengthen its balance sheet in a cost-efficient way and was not ruling anything out. Mr. Galligan responded, “That is what I was afraid you were going to say.” Mr. Ostfeld then reemphasized to Mr. Cunfer and Mr. Cyr that JANA was opposed to such a financing.

After the market closed on March 14, 2023, the Company announced a proposed convertible senior notes offering designed to raise capital to fund the Company’s capacity expansion plan. Based on input from numerous leading financial experts, the Company was confident that the offering would be successful and was the most cost-efficient and expeditious method to raise financing at that time. The Company believed that it was important to conduct the offering as planned and at that time due to the emerging volatility related to Silicon Valley Bank, since the convertible market remained strong and there was risk that the issues at Silicon Valley Bank could worsen or spread to other regional banks which, combined with increasing interest rates, could make a financing more difficult or more expensive for the foreseeable future.

Later on March 14, 2023, Mr. Cyr and Mr. Cunfer reached out to Mr. Ostfeld. During the call, Mr. Ostfeld expressed outrage in a highly unprofessional and combative manner at the Company’s decision to launch the convertible note offering and demanded that the Company downsize the offering. Mr. Ostfeld specifically stated that “The gloves are coming off” and “We are going to war.”

Background to the Solicitation| 17

Before the market opened on March 15, 2023, JANA issued a press release in response to the convertible note offering, noting that JANA was “astonished,” characterizing the offering as “ill conceived,” and asserting that the Board “failed to anticipate the terrible market response to this announcement.” JANA went on to state its belief that the offering was evidence that “Freshpet requires either significant board change, or in the absence of such change, should be sold.”

Later on March 15, 2023, various members of management discussed with other investors the Company’s rationale for the convertible note offering versus other financing alternatives and the favorable terms that were available, including an effective conversion price of $120 per share. The offering was substantially oversubscribed by traditional convertible investors as well as long-only investors, including several large stockholders of the Company. At the end of trading on March 16, two days after the announcement of the convertible note offering, the Company’s Common Stock closed approximately 6.7% higher than the closing price immediately before the offering was announced.

On March 16, 2023, Mr. Ostfeld called Mr. Cyr and Mr. Cunfer separately to discuss the convertible note offering. Mr. Ostfeld acknowledged the success of the offering, congratulated Mr. Cyr and Mr. Cunfer on the execution of the offering and apologized for his prior behavior.

On March 22, 2023, Mr. Steeneck had a conversation with Mr. Ostfeld regarding the convertible note offering. Mr. Steeneck suggested that the Company and JANA could execute a non-disclosure agreement in order to allow the parties to share information that might facilitate a settlement. The parties agreed that their respective legal counsels should discuss next steps.

On March 23, 2023, a representative of Sidley Austin LLP (“Sidley”), the Company’s outside legal counsel, spoke with JANA’s chief legal officer, to begin a series of discussions regarding a potential non-disclosure agreement and paths to a settlement.

On March 31, 2023, Mr. Steeneck, Mr. Cyr and Walter N. George III, then Chair of the Nominating, Governance and Sustainability Committee of the Board, met with Mr. Ostfeld and other representatives of JANA to discuss possible paths toward a settlement agreement, stressing the need to move quickly. Mr. George indicated that as part of its regular refreshment efforts, and with the support of a nationally-recognized director search firm, the Board had identified two strong director candidates, and offered JANA the opportunity to speak with the candidates. The parties also discussed Mr. Norris’ expected departure from the Board in accordance with the previously disclosed age-limit policy and the naming of a new Chair upon his departure. The Company was aware that Mr. Ostfeld was familiar with the two candidates and their credentials and was confident that JANA would find them to be high quality additions to the Board.

On April 12, 2023, the Company hosted an investor event that included a tour of the Company’s new manufacturing facility in Ennis, Texas and discussions with management. A representative of JANA was invited and attended the event.

On April 14, 2023, the Company and JANA executed a non-disclosure agreement.

On April 17, 2023, Mr. George, Mr. Steeneck and Mr. Cyr spoke with Mr. Ostfeld and Mr. Galligan to continue discussions about a potential settlement.

During the week of May 1, 2023, JANA had one-on-one conversations with each of Mr. Biegger and Mr. West. JANA expressed enthusiasm and support for the appointment of both candidates to the Board, expressing that Mr. West in particular would unquestionably be an exceptional addition. JANA was made aware that Mr. West was unavailable to be appointed immediately, but that he would become available to be appointed to the Board upon the dissolution of Conyers Park.

On May 11, 2023, Mr. George, Mr. Steeneck, and Mr. Cyr had another call with Mr. Ostfeld and Mr. Galligan, where the Company representatives reiterated the Company’s interest in a settlement based on the appointment of the two aforementioned director candidates, among other things. The Company stressed again the need to determine promptly whether an amicable agreement could be achieved in the near term. JANA again expressed support for the Company’s two aforementioned director candidates, Mr. Biegger and Mr. West, being added to the Board.

Background to the Solicitation| 18

However, JANA also demanded that the Board appoint two JANA-designated nominees, one of whom had to be Mr. Ostfeld (for a total of four new director appointments), and that two incumbent directors resign from the Board. Further, JANA wanted input into the identification of the new Chair of the Board following Mr. Norris’ retirement pursuant to the director retirement policy.

On May 12, 2023, Mr. Steeneck had a call with Mr. Ostfeld to state that JANA’s demands were not acceptable and not in the best interest of the Company and its stockholders. Mr. Ostfeld responded that, in his experience, companies typically need to feel increased pressure of an impending proxy contest before they concede to JANA’s demands and suggested that the parties resume discussions at a later time. JANA indicated that the Company should feel free to appoint Mr. Biegger and Mr. West on its own timeline.

After nine months of engagement with JANA, which had become a significant distraction for the Company, and no clear path toward settlement, the Board determined that the Annual Meeting would be held in late July, approximately two months earlier than the anniversary of last years’ annual meeting, which would provide stockholders an earlier opportunity to vote on the candidates up for election and express their perspectives on JANA’s demands.

On May 16, 2023, the Board took action to appoint Mr. Biegger to the Board. In light of the Company’s Certificate of Incorporation, which requires that director classes be as nearly equal in size as is practicable, the Board appointed Mr. Biegger to Class I of the Board, which had only two directors at that time.

On May 17, 2023, the Company announced the appointment of Mr. Biegger to the Board and the appointment of Mr. George as Chair of the Board (effective as of the Annual Meeting), and disclosed that the Annual Meeting would be held on July 25, 2023. The Company also formally confirmed that, pursuant to the Company’s director retirement policy adopted and disclosed two years prior, Mr. Norris would not be standing for re-election. Shortly after the announcement, Mr. Cyr called Mr. Galligan to ask if JANA had any questions about the announcement and to reiterate that the Company remained open to an amicable resolution with JANA. Mr. Cyr offered to send JANA a copy of the director questionnaire if JANA was still interested in making nominations.

Also on May 17, 2023, JANA’s outside legal counsel requested a copy of the director questionnaire and representation agreement required by the Company’s Bylaws for any director candidate nominated by a stockholder, which was provided the following day.

On May 24, 2023, the Company received inquiries from a media source regarding a potential letter that JANA planned to issue publicly. Later that day, JANA amended its Schedule 13D, disclosing purchases of the Company’s Common Stock resulting in an increase in ownership to 9.0% of the Company’s Common Stock, and issued a press release disclosing its letter and announcing its intent to nominate four directors to the Company’s Board.

Also on May 24, 2023, the Company issued a statement in response to JANA’s press release.

On May 25, 2023, JANA sent a letter to Sidley and issued a press release alleging that the actions taken by the Board and announced on May 17, 2023 breached the Board’s fiduciary duties. In particular, JANA objected to the fact that the Company had announced that there would only be three seats up for election at the Annual Meeting priordue to Mr. Norris not standing for re-election, despite this outcome being the vote. A proxy may be revokednatural consequence of the director resignation policy adopted in 2021, as acknowledged by a writingMr. Norris at the time of its adoption.

Also on May 25, 2023, JANA delivered notice to the Company statingof its intent to nominate three director candidates, Diane Dietz, Timothy R. McLevish and Scott Ostfeld, to the Board, and identified a fourth candidate, Kurt T. Schmidt, to serve as an alternate in the event that the proxy is revoked, by a subsequent proxy that is submitted via telephone or Internet no laterBoard were to increase the size of the Board to elect more than 11:59 p.m. (Eastern Time) on October [2], 2022, by a subsequent proxy that is signed by the person who signed the earlier proxy and is delivered before orthree directors at the Annual Meeting or by attendanceif more than three directors were to be elected at the Annual Meeting and voting in-person or via the Internet. If you are a beneficial owner and wishfor any other reason.

On May 30, 2023, JANA filed an amendment to change any of your previously provided voting instructions, you must contact your bank, broker or other nominee directly.

Also on May 30, 2023, JANA issued a press release criticizing the Internet at www.proxyvote.com.

Background to the Solicitation| 19

Also on May 30, 2023, the Company sent a letter to JANA’s counsel and issued a press release refuting the allegations set forth in JANA’s May 25, 2023 letter. The Company noted, among other things, that stockholders wish to include in our Proxy Statement and form of proxy for presentation at our 2023 annual meeting must be received by us no later than [April 24, 2023]. Such proposals also must comply with the regulationsMr. Norris’ retirement was a consequence of the SecuritiesCompany’s director retirement policy announced in 2020 and Exchange Commissionadopted in 2021, and that Mr. Biegger’s appointment was supported by JANA and his placement into Class I was required by the Certificate of Incorporation.

On June 1, 2023, JANA filed a complaint (the “SEC”“Complaint”) under Rule 14a-8against the Company and the members of the Securities Exchange ActBoard in the Court of 1934, as amended, regarding the inclusion of stockholder proposals in company-sponsored proxy materials. Proposals should be addressed to: Freshpet, Inc., 400 Plaza Drive, 1st Floor, Secaucus, NJ 07094, Attention: Corporate Secretary.

Also on June 2, 2023, the Company announced that J. David Basto had resigned from the Board effective May 31, 2023 due to other professional obligations, and that the size of the Board had accordingly been decreased.

Also on June 2, 2023, Mr. George, Mr. Steeneck and Mr. Cyr had a call with Mr. Ostfeld regarding a possible settlement. During the conversation, Mr. Steeneck asked if the Company could interview JANA’s three independent director nominees with the goal of appointing one of them to the Board as part of a settlement agreement. Mr. George indicated that the Company was prepared to move expediently to do so. Mr. Ostfeld did not agree to do so and instead was apparently focused on his appointment to the Board. During the call, Mr. Ostfeld claimed, “Every company wants me on their board. The fact that you don’t makes me wonder why.”